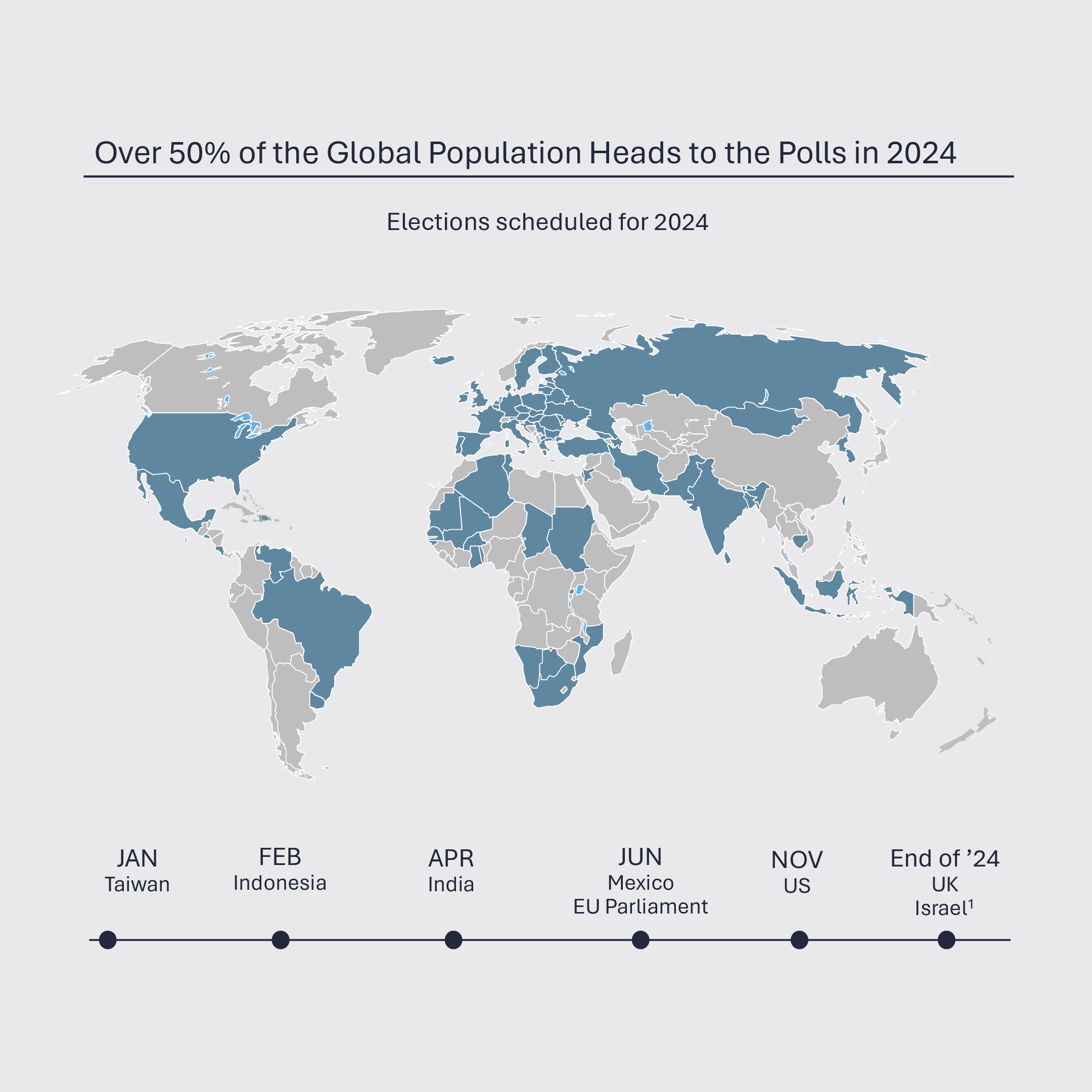

The World Chooses

In 2024, an unprecedented number of voters will head to the polls. An estimated 76 countries are scheduled to hold elections, including some of the world’s most populous — Bangladesh, Brazil, India, Indonesia, Mexico, Pakistan, and the U.S. — positioning 2024 as a year with the potential for political upheaval. While the majority of elections will be determined by domestic dynamics, many will have implications beyond their borders.

At a basic level, election campaigns will take precedence over policy implementation and political attention will turn inward. Divisive and highly partisan elections may be cemented as the new normal. Globally, trust in political and societal institutions will continue to erode.

Implications:

- Divisive rhetoric will inflame domestic tensions and possibly incite violence, with minority groups most at risk

- Geopolitical issues are likely to be influenced by public opinion

- Delays to policy implementation while campaigns are ongoing

1 Likely to be held in 2024 but may be pushed to 2025.

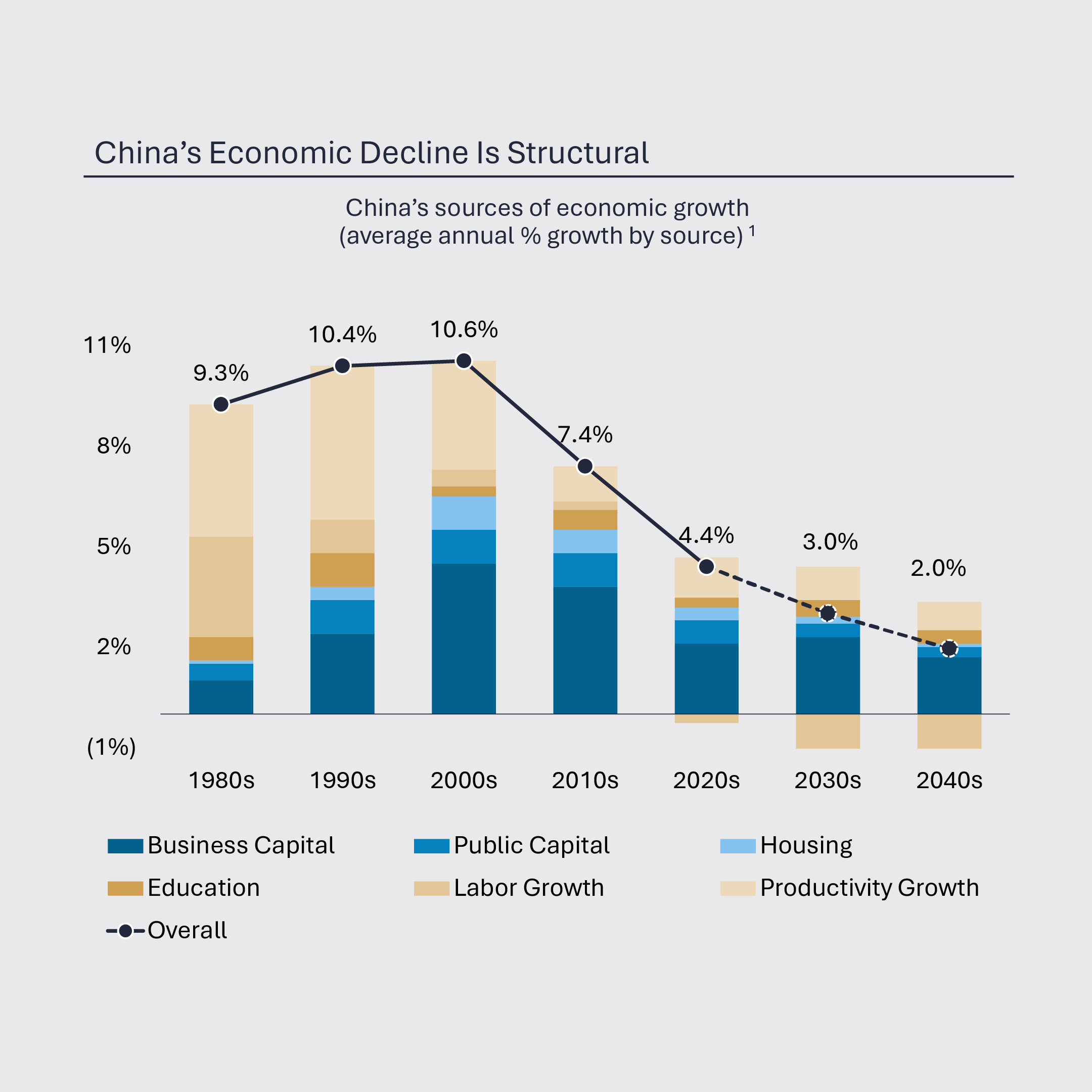

China's Miracle Fades: A Secular Slowdown

China’s structural “slower-for-longer” growth conditions will be felt across regions and industries in 2024. The “new normal” will predominantly impact countries whose own growth has relied on China’s manufacturing role in the global economy. Meanwhile, China’s own reaction to its slowdown will be determinative in the long run. In the short term, Beijing is likely to lean on exports in 2024 to drive growth, driving down prices and putting pressure on producers elsewhere.

Implications:

- Impact for commodity/other exporters reliant on China’s growth

- Sectors dependent on strong domestic Chinese growth will face headwinds

- Escalation of competitive protectionist trade policies

1 Lowy Institute, March 2022.

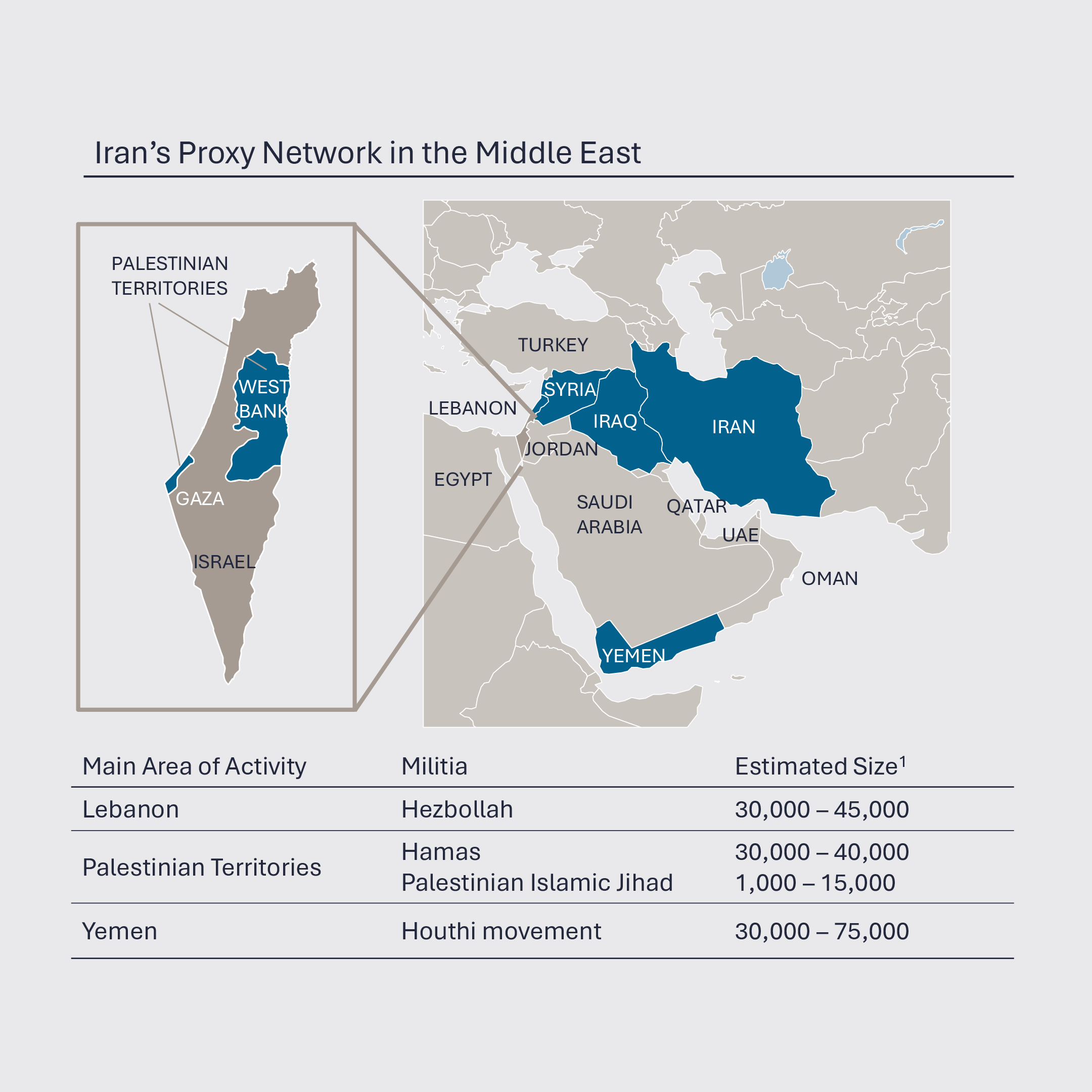

Edging Toward Escalation in the Middle East

The ongoing conflict in the Middle East has brought latent tensions to the fore between Iran and its proxies on one side, and the U.S. and Israel on the other, rekindling concerns about a possible regional escalation of violence. All this takes place against a backdrop of continued uranium enrichment by Iran and — so far — limited pushback against its actions by Sunni Arab states, potentially emboldening Tehran and creating heightened risks for commodity prices and trade flows.

Implications:

- Continued oil and gas price volatility

- Disruption to critical trade routes (e.g., Suez Canal, Strait of Hormuz, Bab el-Mandeb)

- Uncertainty over FDI in Middle East

1 Council on Foreign Relations, UN Security Council.

To request LGA's full Top Geopolitical Trends in 2024 report, please email geopoliticaladvisory@lazard.com.