Despite increased biotechnology financing activity, investor sentiment remains risk-averse, and biopharma indices are volatile. However, biopharmaceutical innovation is robust, with numerous companies reporting compelling data and strong M&A activity. Large pharma continues to focus on sustainable growth amid upcoming patent expirations and a challenging regulatory environment, including the drug provisions of the IRA, anti-trust issues, and the U.S. BIOSECURE Act.

Our 2024 Global Biopharmaceuticals Leaders Study, conducted in June and July, included 291 leaders from major biopharma companies, smaller firms, and investment groups. Participants comprised 238 C-level executives and 53 leading investors, with representation from large-cap, mid-cap, emerging biotechs, and private companies.

Our Central Findings:

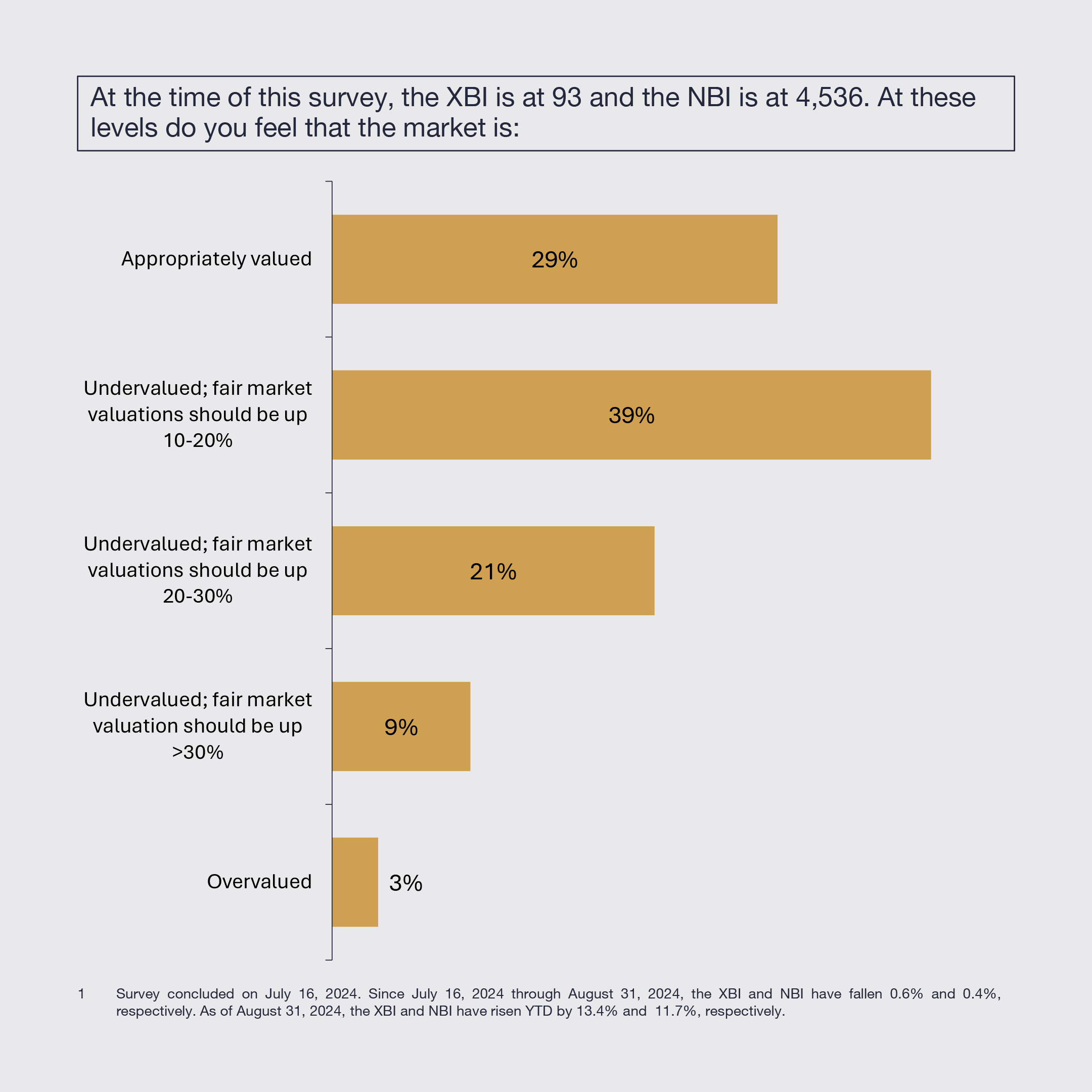

1. Bifurcated Views on Equity Market Valuation with Optimism on Innovation and Financing

Biopharmaceutical constituents disagree about the SPDR S&P Biotech ETF (XBI) and the NASDAQ Biotechnology Index (NBI) valuations. Large pharma executives tend to believe the biotech equity market is appropriately valued, whereas leaders at private, emerging, and mid-cap biotechnology companies tend to believe fair market valuations should be up to 30% higher.

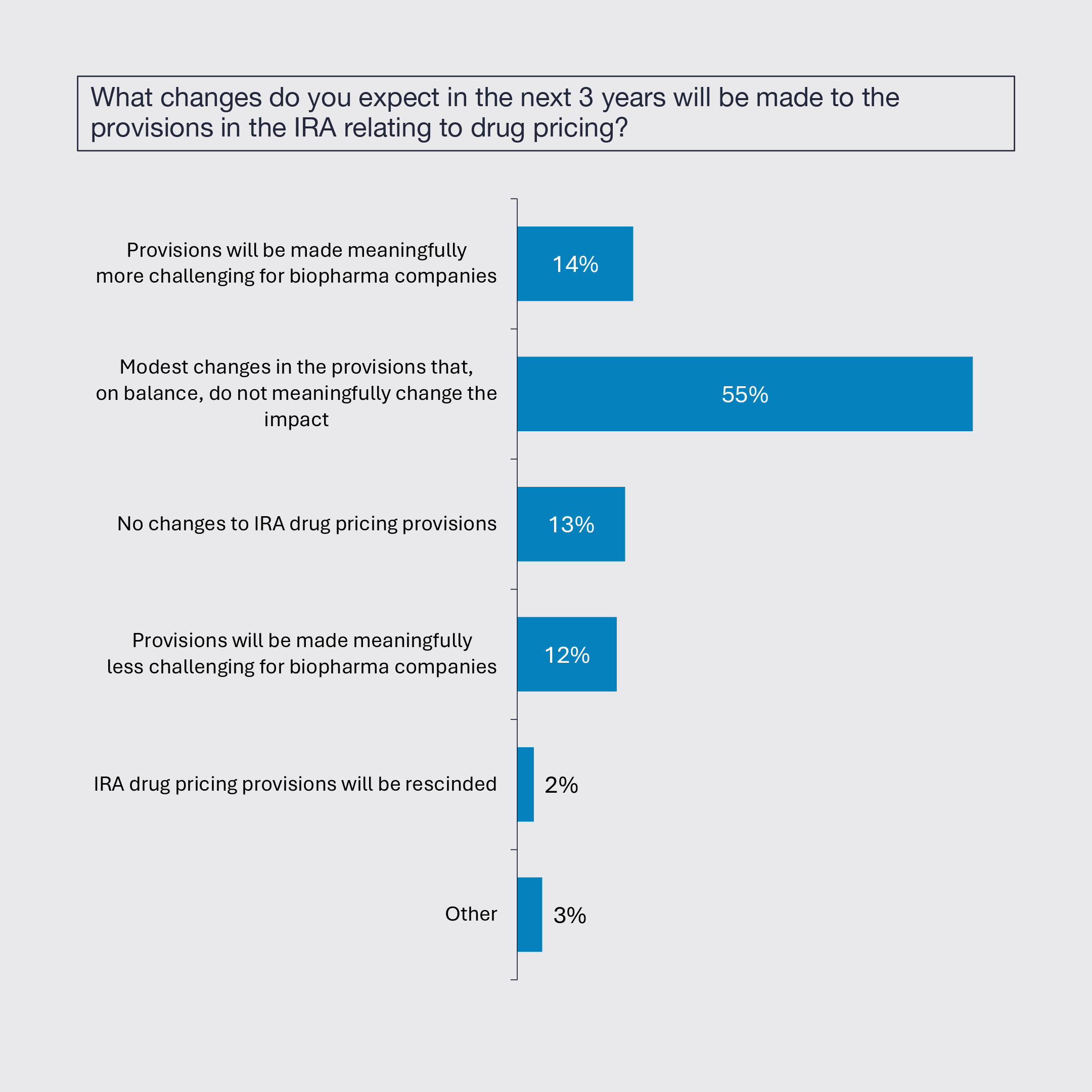

2. IRA Expected to Generally Remain Unchanged

Biopharmaceutical leaders expect modest changes to the drug provisions of the Inflation Reduction Act (IRA) that, on balance, will not meaningfully change its impact, or no changes at all.

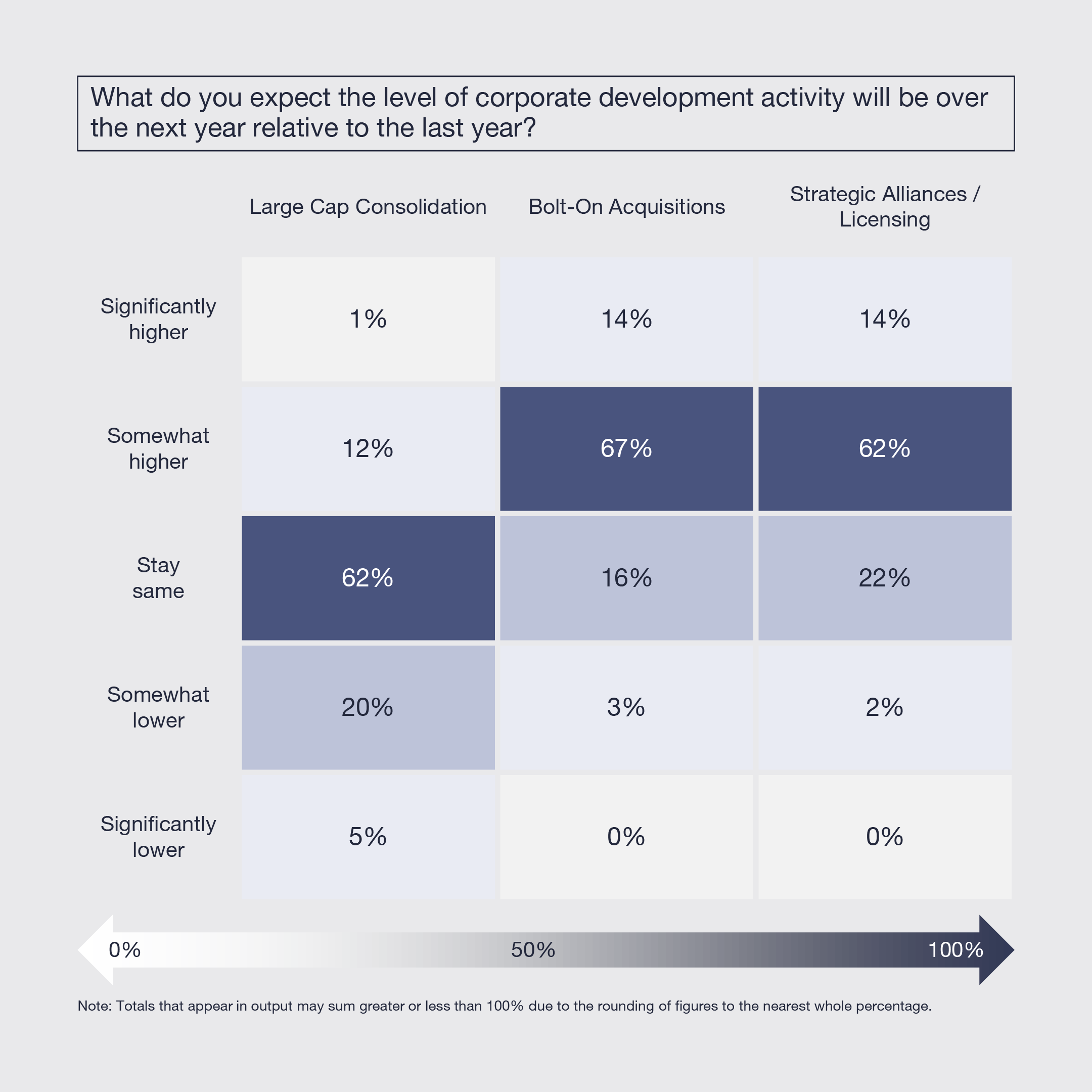

3. Bolt-on M&A and Collaborations Expected to Increase

While large-cap consolidation is expected to remain at the same low level, bolt-on acquisitions and strategic collaborations are expected to increase. The need for growth and innovation, positive clinical data, and more reasonable price levels and value expectations are the drivers for rising strategic activity.

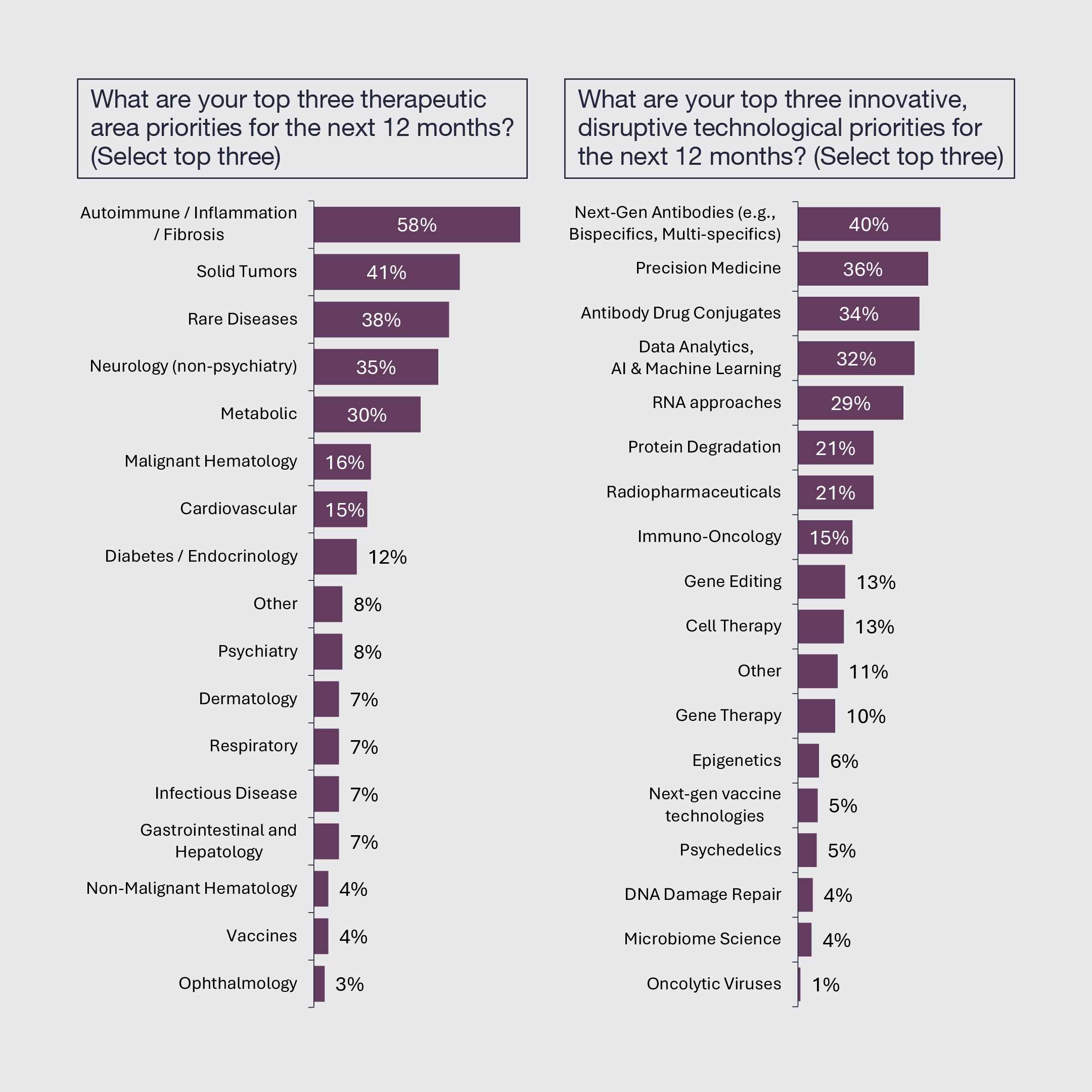

4. Autoimmune, Inflammation, and Fibrosis Remains the Top Therapeutic Area

Autoimmune, inflammation and fibrotic diseases remain the top therapeutic area priority followed by solid tumors, rare diseases, neurology and metabolic diseases. Views on the top innovative technological modalities remain widely distributed, still reflecting the breadth of exciting innovation.

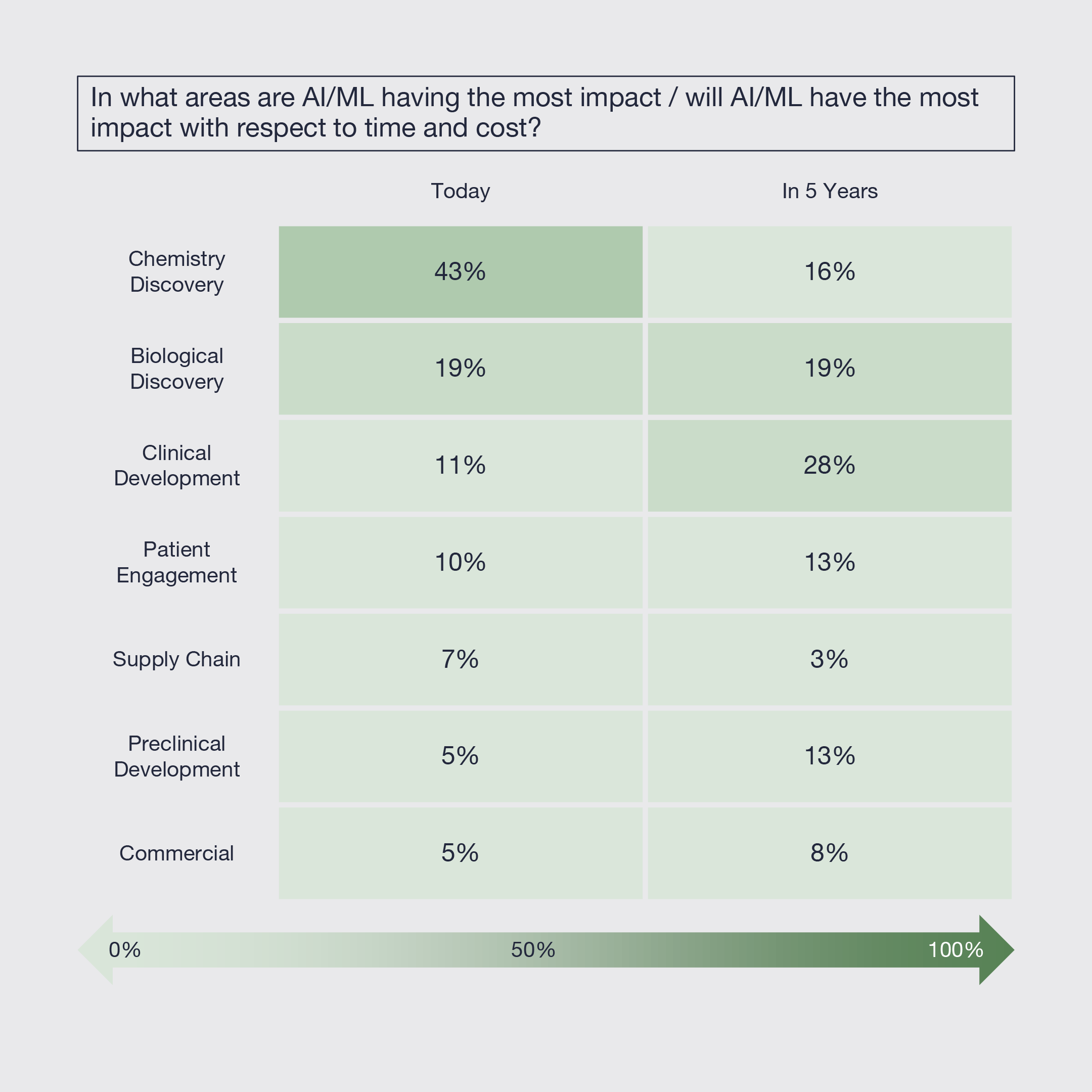

5. Artificial Intelligence and Machine Learning Already Impacting Innovation

Today, Artificial Intelligence and Machine Learning (AI/ML) is having the most significant impact on the time and cost of the chemistry discovery process, followed by biological discovery and then clinical development and patient engagement. Looking forward five years, its impact is expected to shift more towards clinical development and be more broadly distributed across discovery. Limited impact is expected on supply chain and commercial over that timeframe.

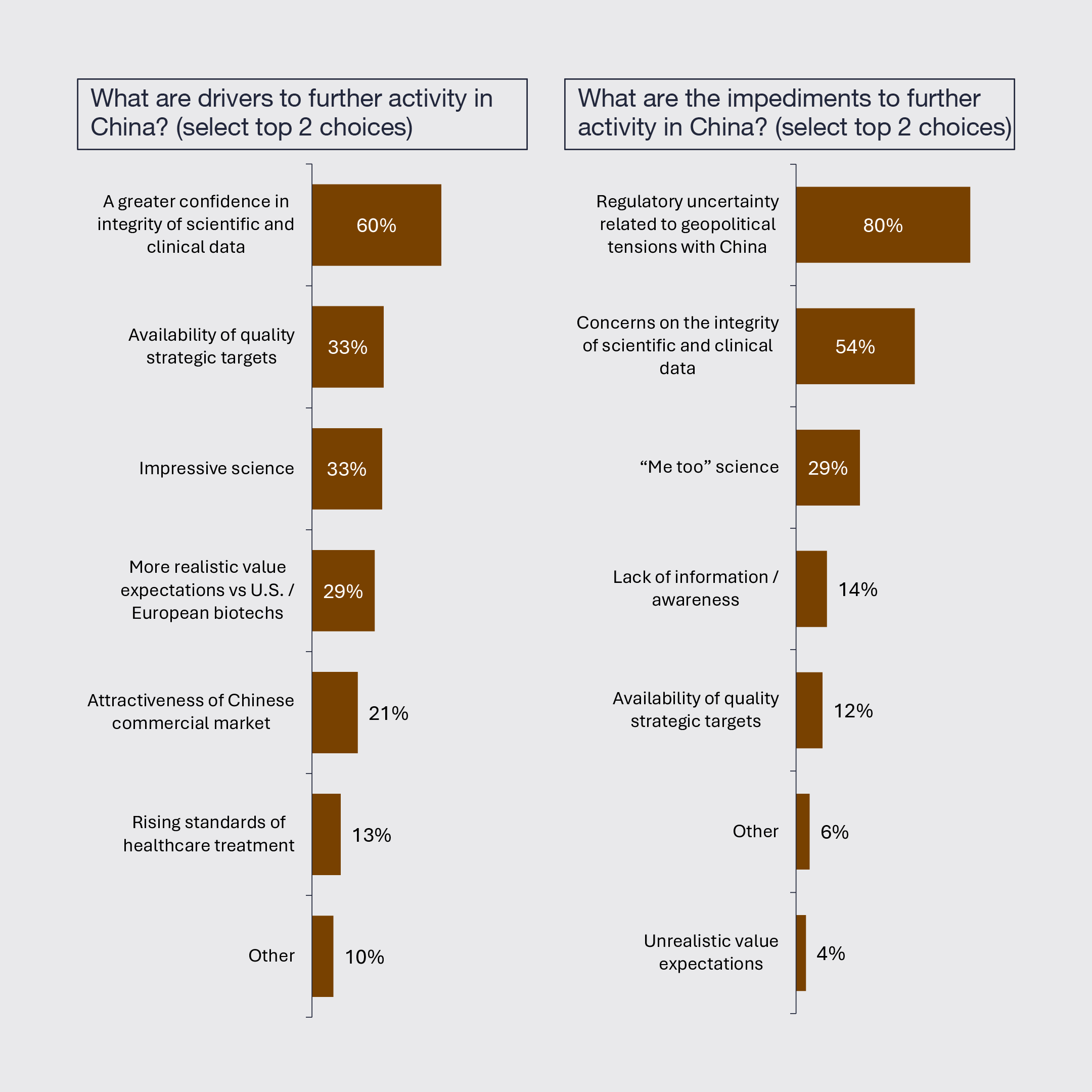

6. China to be a Key Driver of Innovation But Concerns Remain

Biopharmaceutical activity in China will be driven by more confidence in the integrity of data, a rising level of impressive science and the availability of quality strategic targets. However, it will be constrained by regulatory uncertainty related to geopolitical tensions, ongoing concerns about the integrity of data, and continued perceptions of “me too” science. The majority of biopharmaceutical leaders intend to onshore more manufacturing, and a significant portion plan to do the same with research and clinical development.