Introduction

The current geopolitical environment is leading to a more fragmented and polarized world. Reconfiguration of supply chains is at the core of this trend as governments engage in an escalatory industrial policy race, especially in strategic clean energy, advanced electronics, and healthcare technologies.

The Inflation Reduction Act (IRA) and the CHIPS and Science Act in the United States, Europe’s Critical Raw Materials Act, and China’s Made in China 2025 program are all examples of industrial policies focused on two objectives: (1) restoring (or maintaining) manufacturing advantages in strategic sectors, especially clean energy and advanced electronics; and (2) reducing dependencies on geopolitical competitors.

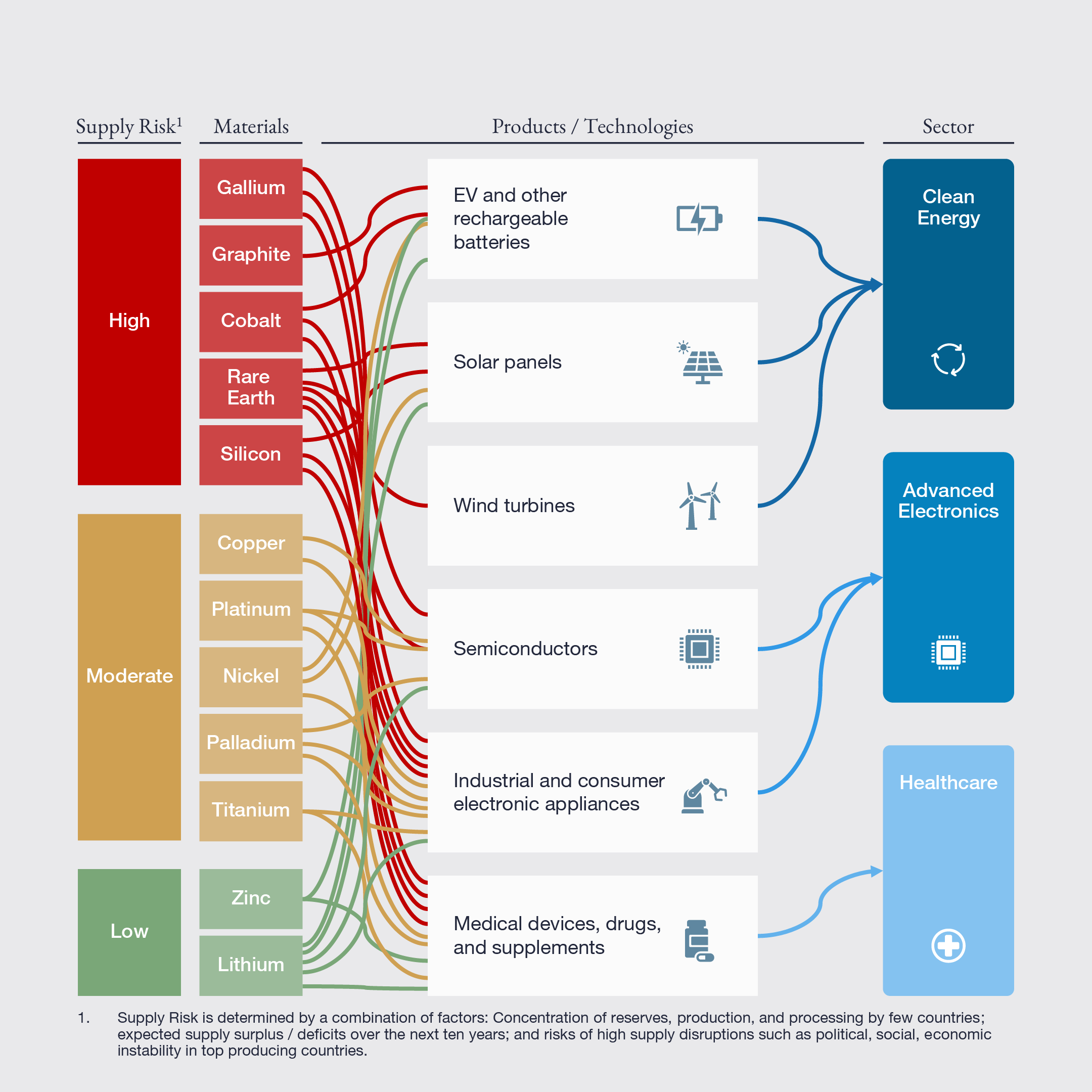

Successfully achieving these goals will be highly dependent on the dynamics at play upstream in the supply chain: the exploration, mining, and processing of critical materials that serve as the building blocks of the global economy.

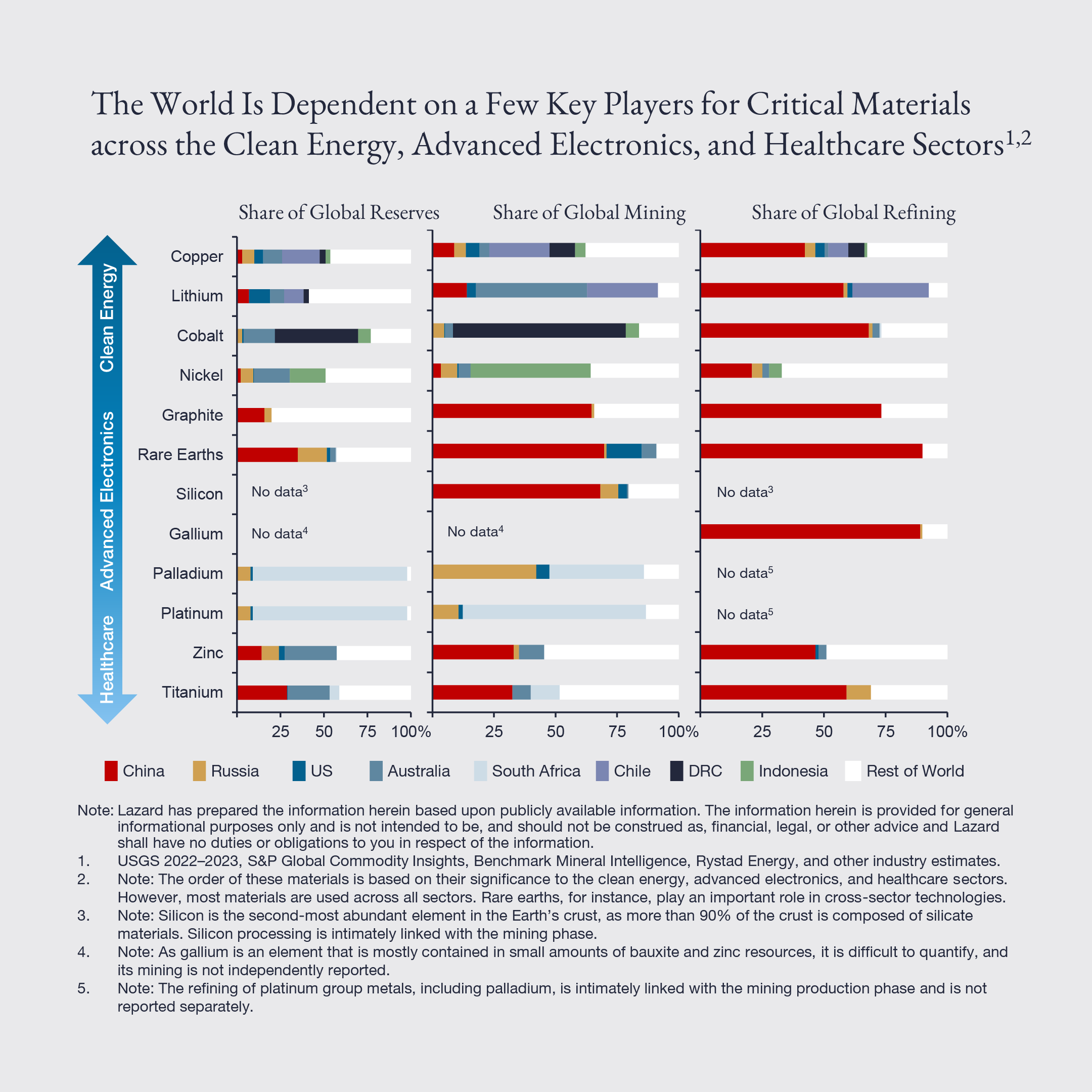

The main risks behind critical materials emerge from their highly concentrated nature. A few countries control the reserves and production of these resources, leading the rest of the world to be extremely dependent on them. Breaking these interdependencies will be extremely difficult over the next decade despite growing industrial policy initiatives.

As critical materials become a more significant point of concern for national security, economic growth, and corporate strategy, the following are the top five risks that could disrupt companies’ supply of critical materials in the years ahead.

Firms will have to make the decision to maintain engagements in geographies that pose significant geopolitical risks (whether via direct operations or supplier relationships) and take political concerns into consideration.

With this in mind, the report provides a series of strategies firms can consider and implement to minimize geopolitical risks, as well to identify potential opportunities in the evolving critical materials environment.

To continue reading the report and its findings, please click here.